Can You Afford To Buy A Condo In Singapore?

Many Singaporeans feel the pinch and often shake their heads when they think of how to buy a condominium in Singapore. Buying is not that hard at all. A lot of property investment Ads tell us it’s so easy.

The latest private housing available in the market touts attractive headlines and fancy photos and lifestyle videos. Kids playing happily in the swimming pool. Gym for you and sauna for your wife to relax. Large cool rooms, beautiful and chic magazine interiors.

A typical Condominium For Sale Ads will look like this;

” Freehold condo near MRT. Choice of 1 – 3 Bedrooms

Attractive low entry price (deposit) from $200,000 ONLY”.

It is the qualification process as well as being able to afford to pay the monthly mortgages for the next 20 or some 30 years that make us cringe.

Good Condo For Investment Doesn’t Mean It’s Affordable

Can the majority of Singaporeans afford to buy a new condo development? The short answer is a sad, “YES”. Why sad? Because leveraging on mortgages and loans and remain in debt for almost the rest of your life – doesn’t seem to be an option.

I too wished that it is otherwise when it comes to affordability and the strong Singapore Dollar. But the facts remain true.

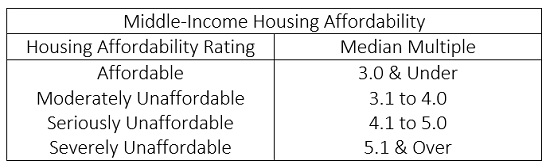

The result of the survey conducted by urban planning policy consultancy Demographia in Q3 2018, the 15th Annual Edition of the Demographia International Housing Affordability Survey (2019) is alarming, to say the least.

The middle-income housing affordability for Singapore is considered “seriously unaffordable”.

In a comparison against the 309 urban housing markets in eight countries (Australia, Canada, Hong Kong-China, Ireland, New Zealand, United Kingdom, United States, and Singapore) the middle-income housing affordability for Singapore is considered “seriously unaffordable”.

Just as the world’s 91 major metropolitan markets (housing markets) and the three megacities (10,000,000 residents) in New York, London, and Los Angeles, the survey for Singapore showed that the median house price is 4.6 times higher than the rest of the major cities.

According to the survey, Hong Kong rank as the world’s least affordable home prices with a median multiple of 20.9, followed by Vancouver came in the second place.

Sydney, Melbourne and San Jose came in third, fourth and fifth, respectively. The sixth, seventh and eighth least affordable housing markets lie in Los Angeles, Auckland, and San Francisco.

London (Greater London Authority) and Toronto were tied in 10th place with a median multiple of 8.3.

What Is The Average Salary Of A Singaporean?

According to tradingeconomics.com, the Singapore Average Monthly Wages (updated on January of 2019) shows the highest wages at $5808.00 and the lowest at $1302.00

In terms of affordability for the average Singaporean, earning at the lower end of the spectrum, it is almost impossible to save for a condo.

House prices in Singapore have a median multiple of 4.6, which means that the median house price is 4.6 times the city-state’s median household income, according to the survey.

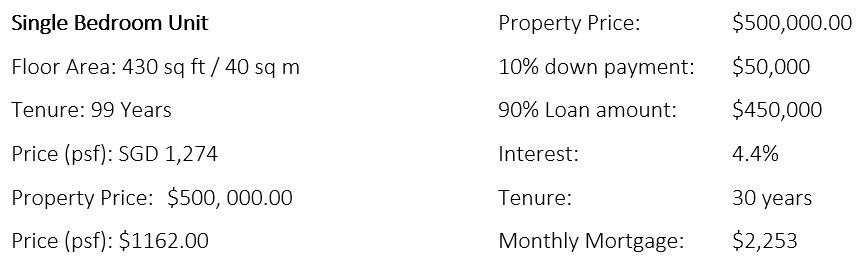

What Is The Cheapest Price Of A New Condo Development?

There are actually fewer listing for Singapore Condo price below $500,000 as compared to the higher priced condo with an upper range of $5,000,000 and beyond. And that is for a SINGLE Bedder!

With the current salary scale and limitations you’d have to be able to afford the repayments before you can even start to plan to buy your condominium.

Are Singaporeans unhappy over the high property prices? What do you think?

Since I Can’t Afford A Condo In Singapore, Maybe I Can Buy One In Malaysia?

For first time homeowners, many are reduced to renting a roof over their heads as it is almost impossible to save the 10% down payment for a condo if your salary is on the low end of the scale at $1500.00.

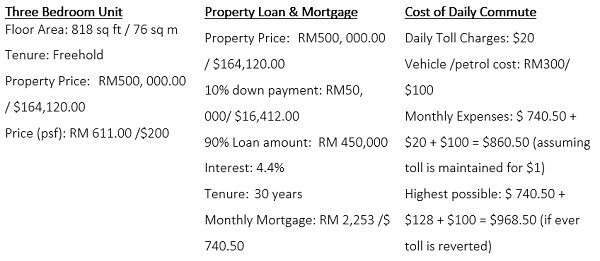

If you’re thinking of buying a home in Johor, Malaysia, the prices of houses there are just as high. The advantage is our strong Singapore Dollar. The disadvantage is dreaded daily commute.

Singapore dollars will help in the conversion but you will need to factor in the time, cost of petrol and vehicle maintenance for commuting. The most daunting task to look forward to every morning – is the journey via the Causeway from Johor into Singapore in time for work, come rain or shine.

Do take a moment and look at the prices before you jump in and buy the next property launch in Johor Bahru.

An unfurnished Serviced Residence in Johor Bahru, Johor;

With Singapore observing only 11 paid Public Holidays a year and according to the Ministry of Manpower Under the nation’s Employment Act, workers get up to a maximum of 14 days paid annual leave.

With Saturday and Sundays off that’s a total of 104 days which you can choose to stay at home.

For the rest of your working days – You will need to pay for toll and petrol for 365 – 11 – 14 – 104 = 236 days.

Which works out to an average of $20 per month (based on $1 per day). If the toll charges are reverted to prior 2018 the average cost is $1534/236 /12 = $128

Possible Moderation Of Prices In Some Of The Most Unaffordable Markets

“Over the past year, there has been moderation of house prices in some of the most unaffordable markets,” noted the report.

“In some markets, prices have stabilized; while in others actual declines have occurred. However, none of the price declines have been sufficient to improve housing affordability.

These developments could, in the long run, simply be a further indication of the price volatility exhibited associated with stronger land use regulation.”

Affordable Housing Markets In USA

“There are 9 affordable major housing markets – all in the United States,” noted the report.

“Pittsburgh and Rochester are the most affordable, with a Median Multiple of 2.6. Oklahoma City has a Median Multiple of 2.7, while Buffalo, Cincinnati, Cleveland and St. Louis each have a 2.8 Median Multiple. Indianapolis (2.9) and Detroit (3.0) are also affordable.”

“Surprisingly The Property Market In The USA Is The Most Affordable In The World”

I’m not suggesting that you buy a house in the USA and move over just so you could buy a property. Rather this is to share with you some data on what we are experiencing in Singapore, Malaysia, and Southeast Asia.

Most of us feel the burden of paying the mortgage of our first home and can only dream of getting a second property. In the USA, it is not uncommon for someone to own more than one property. Americans are able to do this because of the laws in the United States.

Buying into the USA property market for an investment is not a problem for a Singaporean or for that matter anyone who is not a US citizen.

In fact, you do not need a green card, or any particular type of visa to be eligible to own a property in any of the low median states in America. Buying properties in the USA is not a problem for foreigners.

Next, we will update this article with the rules, Law and Taxes topics if you want to start investing in the United States.