While Singaporean buyers are still combing the real estate market overseas, they are rather cautious about increasing their chances of success.

Their guarded concerns weigh in with the uncertainty surrounding Brexit, the rising cost of financing and the high volume of new property supply with a prime price tag.

According to Oxford Economics, the world’s riskiest housing market or dangers are “especially acute” in Australia, Hong Kong, Canada, and Sweden.

With a significant share of floating rate debt, there are ever increasing worries of high debt levels.

Some of the overseas real estate market that Singaporeans have traditionally invested in have changed significantly in the last decade.

Overall the good news is to learn how to capitalize on the current real estate cycles to re-strategise property investment in the best possible way.

New Zealand’s Property Investment

In August 2018, New Zealand has banned most foreigners from buying homes as it tries to tackle spiraling housing prices. Previously the housing market was open to investors worldwide.

House prices have risen to more than 60 percent in the past decade and driven citizen homeownership to its lowest since 1951.

The New Zealand government has passed legislation that allows only New Zealand residents to buy homes in the wake of house-price inflation.

The ban comes as the slump in business confidence threatens to further curb economic growth.

Close on the heels of world’s wealthy elite snapping up most pristine property in the country, the new bill now classifies residential land as “sensitive”.

Non-residents or non-citizens are not allowed to purchase existing homes without the consent of the Overseas Investment Office.

Citizens from Singapore and Australia are exempted from the rules, to comply with existing trade agreements.

However one of the requirements imposed on foreign buyers is they will need to convince regulators that whatever they do will have wider benefits to the country.

There are still buying opportunities in New Zealand for Singaporean buyers for new housing, particularly apartments, rentals and homes available to purchase under rent-to-own or shared-equity arrangements.

Singaporean buyers will be able to invest in retirement villages, student accommodation, and aged-care facilities.

Australian Property Investment

For Singaporeans, Australia remains the most popular choice because of sound fundamentals, relatively high yields and good prospects for rent increases.

Fuelled by foreign interest, Australian property prices have risen sharply, particularly in Sydney and Melbourne.

Singaporean buyers are returning to Perth, as the prices are significantly lower than that in the major cities.

Housing market dangers are “especially acute” in Australia. This has historically posed a threat to economic activity with a lengthy housing boom.

Since August 2018, prices of houses are almost 3 percent down and falling in Australia’s greater capital city statistical areas, with a 5.6 percent in the Sydney market.

In the meantime, Australia’s largest banks have raised mortgage rates, blaming higher funding costs.

The increase came even as the central bank leaves official rates at a record low.

Japan Property Investment Market

Investor interest is expected to heat up for properties particularly in Niseko, a snow resort town on Japan’s northern Hokkaido Island. This town shares many of the same attributes as Australia.

However before you rush to buy properties in Japan, you need to learn about the Japanese mentality toward real estate investment, its poor demographics, along with regional tensions.

While the rest of the world may view properties as a “lasting asset” that will appreciate in value or an inheritance asset for the next generation, Japan doesn’t.

Japan’s buildings and infrastructures have the highest risks in the world. Japanese have some of the world’s best earthquake resistant buildings.

However structural repairs are costly even the best building will be damaged after a few 8.0 earthquakes. In terms of natural disasters, damages by earthquakes, tsunami and nuclear explosions, meltdowns, and accidents make real estate in Japan transient in nature.

Real estate in Japan is assumed to have a useful life of between only 20 and 30 years.

Japan’s aging population combined with an almost zero population growth will implicate her workforce productivity with higher public spending on healthcare/pensions.

Fewer people means downward pressure on real estate demand and major cities like Tokyo and Osaka are plagued by oversupply.

Emerging Asia-Pacific Property Investment Market

In the current environment, property investment market in the “developed markets” in the Asia-Pacific still has the broadest appeal.

The interest is set to rise in 2019 as investors are viewing to buy in the Asian capitals. Top of the list are Bangkok, Thailand; Phnom Penh, Cambodia; and Ho Chi Minh City, Vietnam.

Unless you know the local language, purchasing a property in countries where English is not the official language can pose a problem.

Communicating with officials and using a translator may be an option if you are seriously considering investing.

But would you? Most Singaporeans are wary about signing a translated document.

Positive Property Investment Market

On a positive note, you will be surprised to learn that the risks are relatively limited in key markets like the U.S.A., Germany, France, and China.

In these countries, there has been no significant recent rise in mortgage rates. In fact, in some cases, the mortgage rates have fallen.

Translated this means, classic ‘trigger’ for house price declines is largely absent.

USA Property Investment Market

US property has fallen in value in the years following the financial crisis. For Singaporeans, the favorable exchange rate between the US and Singapore dollars makes this a relatively stable rental return option.

There are many reasons why experienced investors are turning to the US property market for investment opportunities.

For investors, global diversification coupled with the lower capital outlay, competitive interest rates, and capital growth potential is an attractive draw.

There is a unique opportunity for Singaporeans investors to tap into the US market if they go about it the right way. Let me break this down.

Investing in US soil can be a worthwhile strategy, but you should be aware of the benefits and drawbacks before you make a decision. Snapping up US property can provide high rental returns, positive cash flow, and diversification.

As with any investment strategy, investing in offshore real estate and buying properties comes with a series of risks. Investors need to be careful about investing in the USA property market on their own.

Lack of knowledge of the local property market, a foreign tax system and extra administrative costs are some of the pitfalls that plague newbies.

Pros of US Property Investment

a) Accessibility

For young investors, the affordability of US property is appealing with its low entry cost and low demand in distressed markets.

b) Cash Flow Positive

Many US properties are cash flow positive in a rental market. The rental returns are stable and relatively high in comparison to a property in Singapore.

While it is possible to achieve a similar rental return for a property in Singapore, the purchase price would be much higher.

A three bedroom condo (915 psf) in West Coast Drive sells for SGD 1,370 psf and costs SGD$1, 250,000. The rental yield is about of SGD$6, 000/month*

For US property, typically you can earn a return of about 10% on the property cost. Whereas in Singapore, if your property value is SGD$1,250,000 will you earn a return of SGD$12, 500 a month?

c) Capital Growth Potential

In the US market, if you know how to do extensive research with vetting you can buy properties in the suburbs that are likely to yield high rental return and capital growth.

There is a unique opportunity to find properties that have high rental return and capital growth, which can help you build your equity portfolio.

d) Diversification

A diversified investment strategy is the key to investing in different property types across different markets.

When you invest in US property, Singaporean investors can minimize their investment risk by deep level research and to purchase in a good location. Global diversification can allow investors to pay less tax.

Investors can spread their holdings are spread across different nations. This means they fall into smaller income brackets in different state or counties in the USA.

Cons Of US Property Investment

a) Finance Restrictions

In the USA, most banks require that you to put down a deposit, equivalent to about one third of the property purchase price. For instance, if you were to purchase a property for $750,000, you would need $250,000 deposit. This only applies if you require financing.

While US banks impose stricter lending criteria for foreign investors, who require financing, this does not affect you if you do not require a bank loan.

b) Lack Of Local Knowledge

If you decide to invest in the US, you are able to research the area, scour estate agents and search websites. Most of your research can be done online. Your numbers for a suburb may add up and everything may appear good on paper.

Remember that while you can see the images online, you may not know of the other issues of the suburbs. You don’t have access to reliable data on unemployment or crime rates for the suburb.

Or even how the tax system works, the insurance terminology or the things are structured in the USA. But by not having “boots on the ground”, the lack of local knowledge literally means making or breaking a deal.

Even if you do twice as much research, the unseen structural integrity of the property is the major risk factor of investing in US property on your own. If you don’t have room in your budget, a big ticket item like putting in a new roof will cost the highest amount of property damage.

c) Administration For Taxation

Generally, US property held by a foreign investor will be subject to additional requirements as stipulated by the Foreign Investment in Real Property Tax Act.

If you buy property in the US, you will need to file a tax return annually. As a foreigner, you are taxed on your worldwide income, including income from offshore bank accounts, rental income from an overseas property and capital gains on overseas assets.

You will need to visit the income and taxation office (website) of your respective country of origin to find out more details about your tax obligations as a foreign investor.

d) Costs

For non USA resident, you can still own a property in the US. However, you must have a US bank account, which you must set up in person. This means that you’ll need to travel to the US in order to finalize the paperwork.

You will need to factor in the travel cost and miscellaneous expenses which could easily set you back by SGD3, 000. Investing in an overseas market comes with other additional costs such as help from local experts and extra administrative costs.

You’ll need to factor in local property taxes, insurance, and ongoing repairs, maintenance, and management costs.

e) Limited Rights

If you’re not living in the USA, it’s hard to manage the condition of your property. With the different time zone and not being there physically, it is very challenging to manage your properties and even harder to deal with your tenants.

You can make phone calls or even Skype your tenants for general things. But, how will you be able to chase for payment from delinquent tenants?

How do you deal with tenants who harass other tenants?

Or worst still, dealing with tenants who may be mentally ill or have other emotional problems?

How do you evict bad tenants as quickly as possible? US legislation gives more rights to tenants, so even if they don’t do the right thing, the landlord may be sanctioned or reprimanded.

f) Distance

If you’re thinking of managing the property from afar and across a different time zone you will definitely need some help. Experienced property managers and quality tenants are equally hard to find.

The logistical challenge of being a foreign property owner means that you’ll need to do extra research and periodically make a visit to visit your properties.

Even if you are making good money on the rental, can you make the time to travel?

g) Exchange Rate Risk

Investing in any overseas market comes with a degree of exchange rate risk. The USD is subjected to fluctuations and could affect the amount of income you earn.

Your focus should not be on the exchange rate as your property investment may become restricted by exchange-rate disruptions and currency speculations.

Instead, your focus should be geared towards mid to long long-term strategy.

How To Invest In US Property?

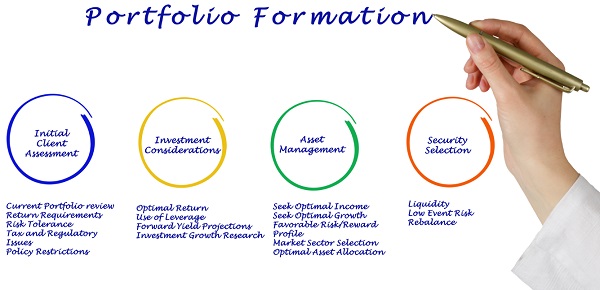

At Noble Sky Institute, we concentrate on deep level research, rigorous vetting and evaluation when we select a property.

We have “boots on the ground” to set foot on every property and thoroughly scrutinize each deal.

Our unique method uses proprietary due diligence principles and conservative financial models. We have what it takes to evaluate repair and rehab cost to know our numbers.

Every deal is evaluated against 4 core criteria to ensure the properties we believe are worth considering are not just “very attractive price” but at a “sensible price” to our investors.

Noble Sky’s 4 Core Criteria

- Commit to what we know: Real Estate Investing in the USA

- Favorable mid to long-term sustainability and property value gains

- Find good and honest managers and contractors in the USA

Buying properties through auction ~ Value For Money.

If you want to buy a property in the US, you can download a guide to the general process where you gain access to Noble Sky Institute’s 2-Day FLEX Workshop.

We will cover these topics in details.

- Market research

- Work with local experts

- Organize finance

- Set up US bank account

- Set up a global money transfer account

- Finalize paperwork

- Exit Strategy

Was this content helpful to you? Yes or No, please leave your comments below.